19û

| | | We Do Not | Ø | No employment contracts for NEOs: We do not have individual employment agreements with any of our NEOs. | Ø | ûNo special benefit plans:We do not provide any benefit plans to our executives that are not generally available to other employees and we do not provide any supplemental executive retirement plan benefits to any executive. | Ø | ûNo hedging or pledging:Directors and executive officers, including NEOs, are prohibited from hedging Company securities, holding Company securities in a margin account or otherwise pledging Company securities, including as collateral for a loan. | Ø | ûNo excise tax gross ups:gross-ups: We do not provide excise tax gross upsgross-ups for any employee. | | |

Compensation Discussion and Analysis Compensation Program and Objectives The Company's 20172020 executive compensation program and compensation decisions were based on the following principles: | | | | | | | | | | | | Pay for Performance:Pay-for-Performance

Our compensation should reflect financial and non-financial performance over short- and long-term periods at the Company business segment, and individual performance.performance levels.

| Balanced Compensation Structure:Structure

We seek to deliver a mix of fixed and variable compensation that is aligned with shareholder interests andaligns the long-term interests of the Companyour executive officers with our shareholders and that appropriately balances risk and reward. | Market-Competitive Pay Opportunity:Opportunity

Our compensation should be competitive relative to our peers and the broader market in order to attract, motivate and retain a talentedtop executive team.talent.

|

Pay for Performance

Our compensation program is grounded onin a pay for performancepay-for-performance philosophy andthat is designed to reward achievement of the Company's financial and strategic goals included in our business plans established before each performance cycle. We considerobjectives. In determining executive compensation, the Compensation Committee considers financial performance and strategic performance factors, relative performance, risk performance, regulatory compliance, internal pay equity and individual NEO performance. The majority of compensation for our NEOs is in the form of variable compensation, a substantial portion of which is paid in deferred RSUs and PSUs tied to the long-term performance of the Company and designed to be aligned with shareholder interests. Performance factors considered by the Compensation Committee in setting and determining executive compensation included the following: •Financial Performance: How well the Company performed compared to its 2017 Annual Plan. For 2017,2020, the main factorfactors the Compensation Committee considered in evaluating financial performance waswere the Company's PBTR.PBTR performance and EPS. •Other Performance Factors: How wellThe Compensation Committee also considered Company performance with respect to the following factors: –Other Financial Metrics: Company performance relative to the Company's Annual Operating Plan (the "Annual Plan"), and prior year results for the following: net income; return on equity ("ROE") (and risk-adjusted returns); total revenue (defined as net interest income plus other income); net charge-offs; and operating expenses. –Key Focus Areas: Extent to which the Company performed compared toaccelerated profitable growth, enhanced capabilities and operating model, grew consumer deposits, profitably scaled Payments business, and progress on maturing risk management and compliance. –Relative Performance: Company performance against a select group of competitors on profitability, credit performance, growth,Total Shareholder Return (" TSR"), and other secondary financial metrics, key focus areas as well as relative to competitors.measures. | | – | Other Financial Metrics:• How well the Company performed compared to other secondary financial metrics, including net income, return on equity ("ROE") (and risk-adjusted returns), earnings per share ("EPS"), total revenue (defined as net interest income plus other income), net charge-offs and operating expenses. |

| | – | Key Focus Areas: How well the Company accelerated profitable growth, enhanced capabilities and operating models, and matured risk management.

|

| | – | Relative Performance: How well the Company performed against a select group of competitors on profitability, credit performance, growth, total shareholder return and other measures.

|

Risk Performance: How well the Company performedperformance with respect to risk management, capital adequacy, and regulatory compliance. •Individual Performance: How well each NEO performedEach NEO's performance relative to individual objectives, including relative role impact, experience, and internal pay equity.

20

Compensation Discussion and Analysis

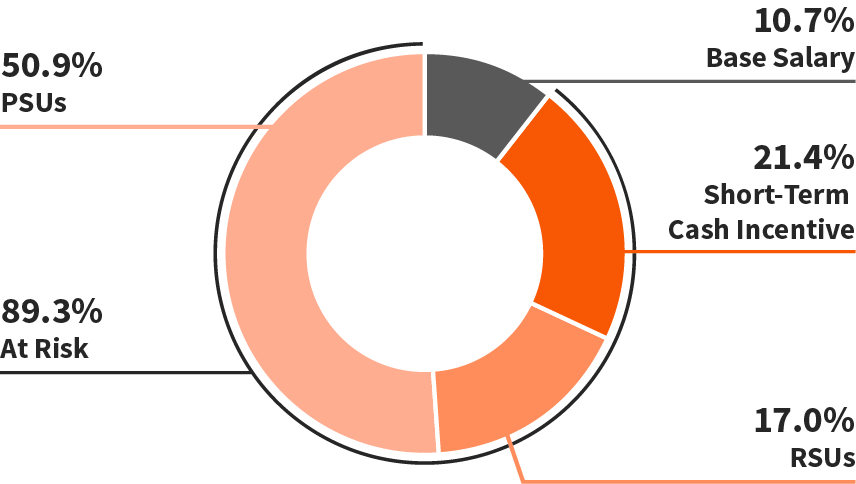

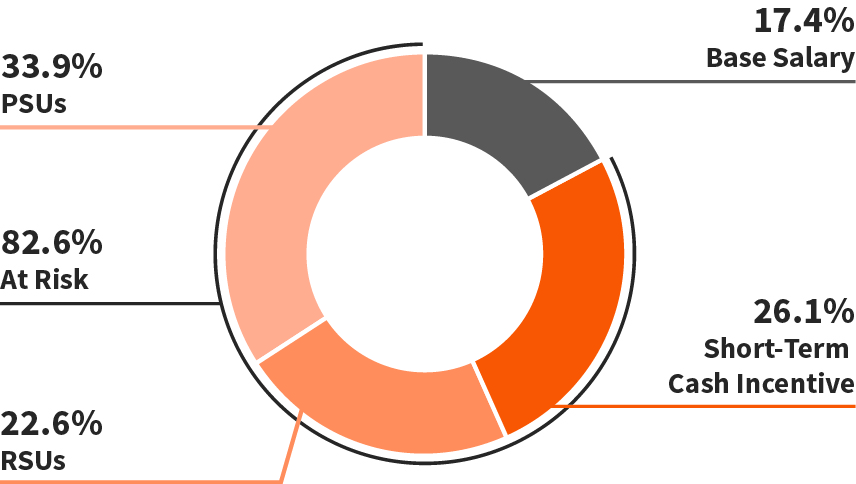

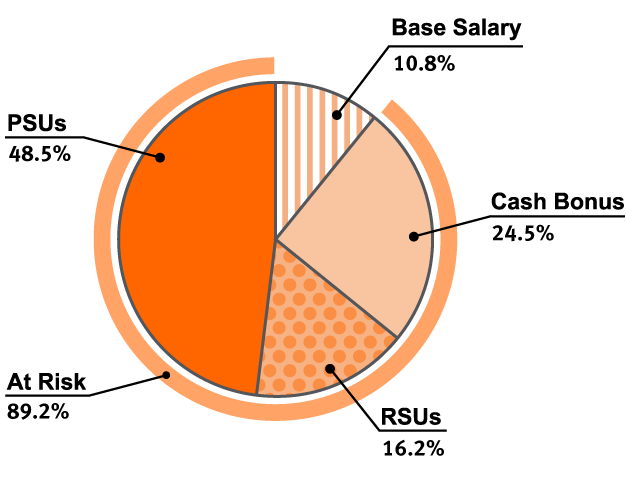

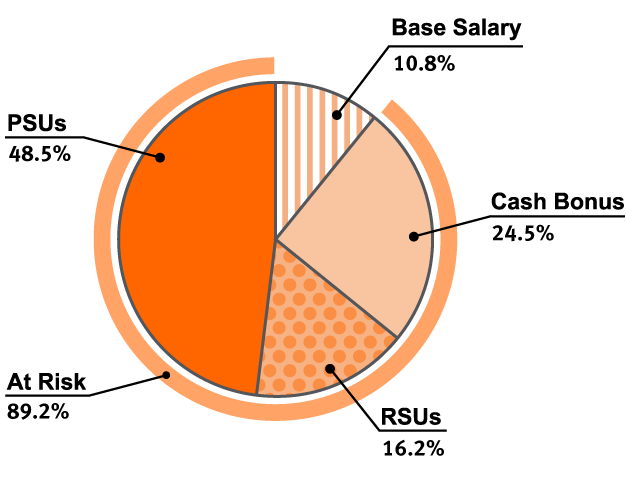

Balanced Compensation Structure  The Compensation Committee determines the total direct compensation targets (aggregateopportunity (sum of base salary, target short-term incentive ("STI")STI and LTI opportunity)opportunities) for theeach of our NEOs at the beginning of the year, based on Company and individual performance forduring the pastprior year as well as the overall skills and experiences of the executive, internal pay equity and the Compensation Committee's assessment of their future potential. Target STI and LTI opportunities are established for, and communicated to, the NEOs.NEOs at the beginning of the year or, if later, at the time of any subsequent change in STI or LTI opportunity. The actual year-end STI awards paid and LTI awards made to the NEOs are determined by the Compensation Committee based on its evaluation of financial performance, primarily PBTR for STI, and other performance factors, risk performance and individual performance, and adjusted EPS for LTI (as described above)beginning on page 36). The Compensation Committee also considers compensation levels of other executives in similar roles both within the Company and at industry peers before making compensation decisions. The Compensation Committee usesexercises discretion to exercisein its judgment instead of solely relying on a formulaic structure, which it believes provides the right level of transparency while maintaining the flexibility necessary to pay appropriatelyamounts it deems appropriate for performance. The Compensation Committee has determined that a balance of the following pay components provides an effective combination of risk and reward: | | | | Base Salary: | | | | | | | | | | | | | | | | | (At Risk) | | | | | Element | Base Salary | Short-Term Incentive ("STI") | Long-Term Incentive ("LTI") | | Highlights | Fixed cash compensation based on scope of responsibility, impact on the organization, expertise, experience, and individual performance. | Annual cash bonus opportunity based on Company financial performance, primarily PBTR, other performance factors, risk and individual performance. | Annual equity award opportunity based on financial performance, other performance factors, risk and individual performance; granted as a mix of PSUs and RSUs with PSU awards vesting based on adjusted EPS. | | 2020 CEO Target Pay Mix | 10.7% | 21.4% | RSUs 17.0% | PSUs 50.9% | | | | | | 2020 Average of All Other Named Executive Officers ("NEOs") Target Pay Mix | 17.4% | 26.1% | RSUs 22.6% | PSUs 33.9% | | | | |

Fixed compensation based on scope of responsibility, impact on the organization, expertise, experience, and individual performance.

| Short-Term Incentive:

Annual cash bonus opportunity based on Company financial performance, primarily PBTR, and other performance factors, risk and individual performance.

| Long-Term Incentive:

Annual stock award opportunity based on financial performance, other performance factors, risk and individual performance. The award is granted using a mix of PSUs and RSUs.

|

Review of Compensation Policies and Practices Related to Risk Management The Compensation Committee is responsible for overseeing risk management associated with the Company's compensation practices. The Compensation Committee at least annually meets with the Company's Chief Risk Officer to review all employee compensation plans, in which employees (including the NEOs) participate, and to evaluate whether these plans havecontain any features that might encourage excessiveimprudent risk-taking that could threaten the value of the Company or are reasonably likely to have a material adverse effect on the Company. The Compensation Committee also continues to monitor a separate, on-going risk assessment by senior management of the Company's employee compensation practices in order to evaluate compliance with the Interagency Guidance on Sound Incentive Compensation Policies issued by the Federal Reserve Board and other bank regulators in 2010.2010, and any updates thereto that may be issued from time to time. Based on an assessment of enterprise risk events, the Company's Chief Risk Officer may direct senior leaders from the Company's Human Resources, Legal, and Risk Management teams to compile and analyze information about the Company's incentive compensation practices and payment history and to holdconduct interviews with business line managers to understand how evaluation of business risk events affect certain STI and LTI performance measures and compensation decisions. After evaluation of the data, and prior to current year incentive compensation decisions, the Chief Risk Officer prepares a report of the risk assessment, which includes any recommendations for risk adjustments to incentive compensation in connection with risk events. In addition, prior to vesting, the Chief Risk Officer reviews a risk assessment of business and individual risk performance over the past three years and certifies whether outstanding LTI awards should vest without adjustment. The Chief Risk Officer's performance during the period is reviewed by the Risk Oversight Committee. In 2017,2020, the Compensation Committee conducted its assessment with the assistance of our Chief Risk Officer to consider whether any element of the compensation structure, design, review, or decision-making process could be reasonably likely to have a material adverse effect on the Company. The Compensation Committee found that incentive compensation continues to be firmly tied to current and future Company performance and is designed to appropriately balance risk and reward and does not have a material adverse effect on the

Compensation Discussion and Analysis Company. The Compensation Committee evaluated our NEOs' performance against risk goals before determining compensation for our NEOs, creating a direct link between our incentive compensation and risk management. In 2020, in connection with makingits compensation decisions, the Compensation Committee reviewed reports from and met with the Company's Chief Risk Officer and the Risk Oversight and Audit Committees of the Board of Directors in a joint meetingmeetings (the "Joint Meeting"Meetings") to discuss the annual incentive compensation risk assessment and to review outcomes of certain risk events and any impact on compensation decisions. The annual risk assessment did not result in the identification of any risks related to our incentive compensation plans that are, either individually or in the aggregate, reasonably likely to encourage excessiveimprudent risk-taking that could threaten the value of the Company or have a material adverse effect on the Company. Following the Joint Meeting,Meetings, the Committee assessed and finalized incentive compensation decisions without any adjustment based on the risk assessment.decisions.

Market-Competitive Pay Opportunity The Compensation Committee reviewed and considered competitive market data from the following two sources when approving NEO compensation: proxy data from an established peer group of companies (discussed below) and other market survey data. We use competitive market data as a reference pointfrom companies within the financial services industry and others with whom we compete for elements of NEO compensation, and not to make any specific decisions.talent. For the proxy data,benchmarking purposes, the peer group used in the analysis consists of 16 financial services companies of a

21

similar business nature and revenue size to the Company, from which the Company might expect to draw and compete for executive talent. Given that the Company has few direct competitors of similar scope, size, and business model, this peer group is somewhat varied in nature and primarily represents companies that are similar in business areas with a focus on credit card providers, regional financial institutions that have significant credit card and/or loan operations, payments processing and data/transaction processing companies. In 2017,2019, the Compensation Committee reviewed the companies that met the foregoing criteria, along with all incumbent peers,2019 peer group and, after evaluating thesethe companies with Pearl Meyerthe Compensation Consultant, made no changes into the peer group.group to be used for evaluating 2020 compensation decisions. In 2017, theThe peer group consisted of the following companies:

| | | | | | | | | | | | •Ally Financial, Inc. | | •American Express Company •Ameriprise Financial, Inc. •Capital One Financial Corporation •CIT Group Inc. | | Fiserv, Inc. | | Regions Financial Corporation | American Express Company | | •Comerica Incorporated | | KeyCorp | | Synchrony Financial | Ameriprise Financial, Inc. | | •Fidelity National Information Services, Inc. | | •Fifth Third Bancorp •Fiserv, Inc. •KeyCorp •M&T Bank Corporation | | •Mastercard Incorporated •Regions Financial Corporation •Synchrony Financial •Visa Inc. | Capital One Financial Corporation | | Fifth Third Bancorp | | Mastercard Incorporated | | •The Western Union Company | | | | | | | |

In 2020, the Compensation Committee reviewed the peer group based on the criteria noted above and decided to remove Ameriprise Financial, Inc. from the peer group and add PayPal Holdings, Inc. PayPal Holdings, Inc. was identified as a better size and business-appropriate peer while Amerprise Financial, Inc. was determined by the Compensation Committee, based on lack of peer group overlap and operations almost exclusively in wealth management, to be a less suitable peer. This change will be effective with respect to the peer group used to evaluate 2021 compensation decisions. 2017

Components of Compensation 2020 compensation decisions for our NEOs were closely tied to our 2020 financial performance and consisted of three key components - base salary, STI, and LTI, with a significant portion of total compensation tied to long-term Company performance. These components are summarized below. Base Salary We provide our NEOs with market-competitive annual base salaries to attract and retain an appropriate caliber of talent for each position. Annually, we review our competitive market, including market data provided by the Compensation Consultant for our proxy peer group and the broader market. In early 2020, in recognition of Mr. Hochschild's performance as CEO, and to bring his compensation closer to market-competitive levels, the Compensation Committee approved a $154,500 increase to his base salary. None of the other NEOs received a base salary adjustment in 2020. See "2020 Summary Compensation Table" for a summary of 2020 NEO base salaries. Short-Term Incentive Program In 2020, we continued to offer our NEOs the opportunity to earn a market-competitive annual cash award through our STI program. Awards may be earned based primarily on the Company's financial performance, while incorporating other secondary performance factors, risk performance, and individual performance. The STI opportunity is provided to create additional motivation for the executives to achieve our annual business goals and to enable us to attract and retain an appropriate caliber of talent for each position, recognizing that similar annual STI opportunities are provided at other companies with which we compete for talent. Our NEOs have target STI opportunities, represented on the "2020 Grants of Plan-Based Awards" table, which were communicated to them at the beginning of the year.

Compensation Discussion and Analysis In early 2020, in recognition of Mr. Hochschild's performance as CEO, and to bring his compensation closer to market-competitive levels, the Compensation Committee approved a 14% increase in his STI target. In recognition of their experience and performance, the Compensation Committee also approved a 20% increase to the STI target for Mses. Offereins and Loeger and Mr. Minetti. The Compensation Committee considered market changes, individual performance, experience, and internal pay equity amongst the Company's executive officers in setting 2020 STI targets. In 2020, PBTR was the primary performance factor considered when the Committee approved annual and long-term incentive funding. PBTR performance against Compensation Committee-approved targets establishes the pool for funding company-wide STI awards. PBTR is derived by adding changes in the allowance for credit losses and reserves for unfunded commitments to pretax income. PBTR is a non-GAAP financial measure that should be viewed in addition to, and not as a substitute for, the Company's reported results. The Compensation Committee believes that PBTR is a critical measure of the core operating performance of the business and focuses on factors the Company's incentive-eligible employees are most able to directly impact and influence and mitigates variability due to significant macroeconomic impacts. In 2019, the Compensation Committee approved changes to the Company's STI program taking effect for 2020. For 2020, the Committee approved target STI funding for achievement of 2% year-over-year PBTR growth and a performance/ payout curve defining potential funding levels based on various levels of PBTR performance. The curve was structured to provide threshold funding of 70% of target and maximum funding of 130% based on PBTR performance. For NEOs, a 1.5x multiplier is then applied resulting in threshold funding of 55% of target and maximum funding of 145% of target. The Committee reviews multiple facets of Company performance when ultimately approving the STI funding level. When the Committee approved the 2020 funding goal and curve in January 2020, it considered multiple factors, including the business plan, historical performance and general market conditions and determined that a 2% growth goal reflected appropriate challenge. The Compensation Committee did not make adjustments to the 2020 PBTR targets or performance/ payout curve in response to the COVID-19 pandemic. In 2020, based on net income of $1,141 million, the Company achieved PBTR of $3,834 million(1), reflecting a 8%(1) year-over-year decrease. The Committee made adjustments to the results for incentive purposes, as defined in the Omnibus Incentive Plan document, to account for approximately $100 million of non-recurring expenses primarily associated with software write-offs and the reduction of the Company’s real estate footprint. When determining individual 2020 STI compensation decisions for NEOs, the Compensation Committee assessed PBTR versus prior-year performance and made discretionary adjustments to the STI payouts for each of the NEOs based on a number of factors, including individual performance and risk performance. In making final assessments and award decisions for individual NEOs in 2020, the Compensation Committee conducted a qualitative assessment of NEO performance against individual goals, which included specific goals to help manage the impact of COVID-19. The Compensation Committee also considered secondary Company performance factors, including performance against the Annual Plan, net income, ROE (and risk-adjusted returns), EPS, total revenue (defined as net interest income plus other income), net charge-offs, operating expenses, key focus areas, relative performance, risk performance, regulatory compliance, internal pay equity, and individual performance. The Compensation Committee believes this approach provides the appropriate level of transparency while maintaining the flexibility to adjust awards for extraordinary circumstances that positively or negatively affect the Company's financial performance. This approach also allows the Compensation Committee to evaluate whether pay is commensurate with risks taken and the quality of performance results. Shortly following the COVID-19 outbreak, management considered the actions necessary to sustain the business through the pandemic and established as COVID-19-related key focus areas: protecting employees and our franchise; maintaining strong liquidity position; managing credit and collections; reducing operating expenses; sustaining brand capabilities; and sustaining profitable growth momentum. Management shared these focus areas with the Committee and regularly measured and updated the Committee on its performance against these stated goals. Through the fourth quarter, management achieved each of the goals, and continues to monitor its performance as a number of these items continue as priorities in 2021. The Compensation Committee considered performance in these key focus areas in addition to management's regular and previously stated goals in awarding compensation to our executives. See "2020 Decision-Making Process" below for more details on the factors considered by the Compensation Committee in compensation decisions and see "2020 Summary Compensation Table" for actual STI payouts to the NEOs.

____________________ (1)Profit before taxes and reserves ("PBTR") is a non-GAAP financial measure which should be viewed in addition to, not as a substitute for, the Company's reported results. PBTR is derived by adding the increase in the allowance for credit losses of $2,382 million, the build of the liability for expected credit losses on unfunded commitments for $17 million, and income tax expense of $294 million to net income of $1,141 million. The Compensation and Leadership Development Committee believes that PBTR is a critical measure of the core operating performance of the business that increases focus on factors the Company's incentive-eligible employees are most able to directly impact and influence and controls for variability in significant macroeconomic impacts. Please see "Annex A" for a reconciliation of PBTR growth to net income growth calculated in accordance with GAAP.

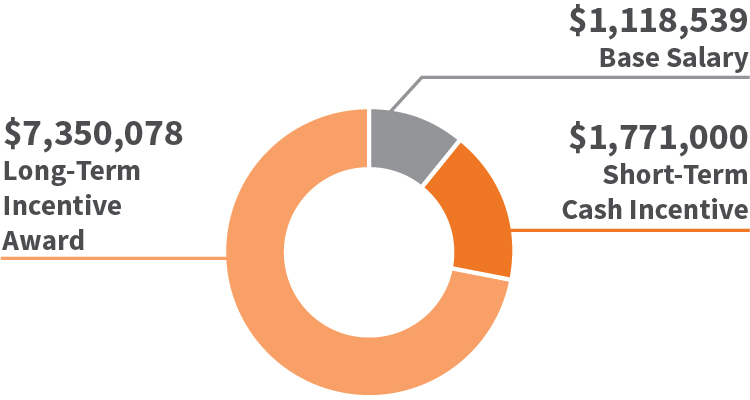

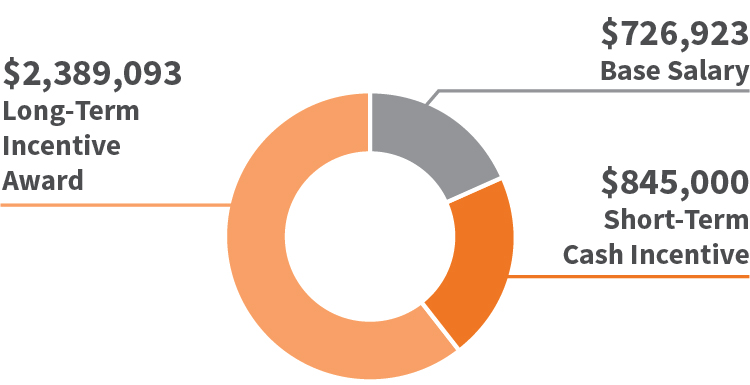

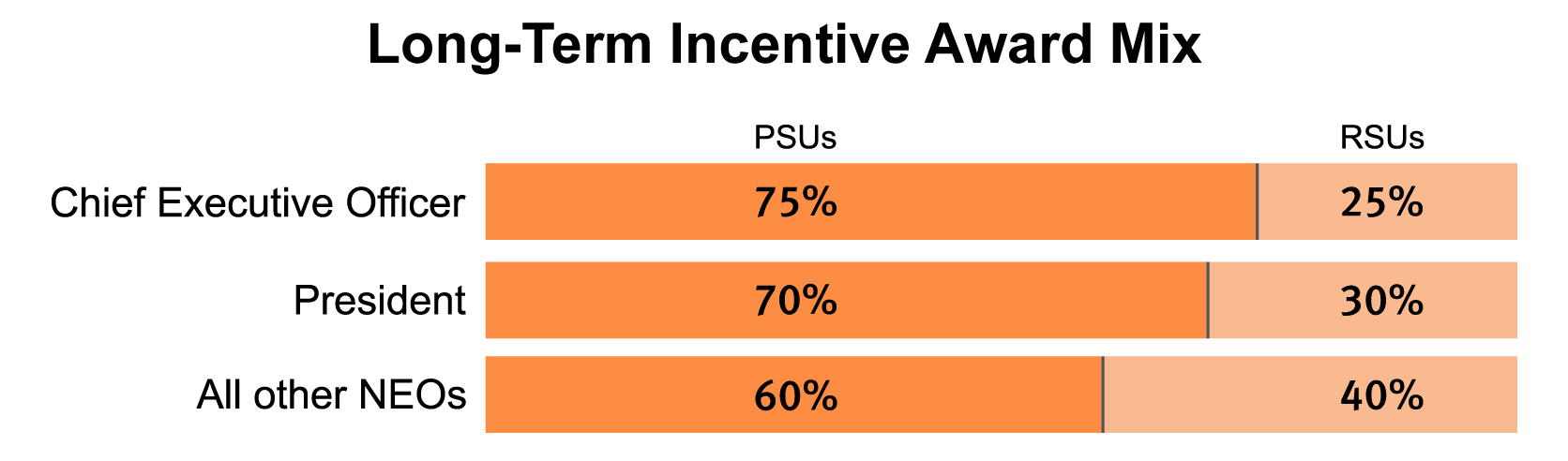

Compensation Discussion and Analysis Long-Term Incentive Program The Compensation Committee, with input from the Compensation Consultant, continues to emphasize stock-based compensation for our NEOs to align their long-term interests with those of our shareholders. The Compensation Committee believes that the use of RSUs and PSUs that vest over a multi-year period focuses executives on the Company's long-term interests without leading to imprudent risk-taking. In addition, we believe time-vested RSUs and time-vested and performance-based PSUs represent an efficient method of delivering long-term stock compensation, generally using fewer shares than other types of stock-based award vehicles while delivering value that is ultimately tied to Company operational or stock price performance. For 2020, the Compensation Committee approved a combination of RSUs that generally vest ratably over a three-year period and at-risk PSUs tied to a three-year Company performance and vesting period (all pending evaluation against the Company's risk policies). Awards of RSUs and PSUs are subject to a clawback that allows the Company to reclaim previously granted awards under certain circumstances. The Compensation Committee sets long-term stock compensation commensurate with level in the organization to appropriately motivate the individuals and further align their interests with those of our shareholders. The Compensation Committee established a target LTI value for the NEOs, represented as a percentage of their base salaries, and determined that 68% of the target compensation of the CEO and, on average, 57% of the target compensation of the other NEOs, would be in the form of long-term stock compensation. In addition, the Compensation Committee established a target PSU and RSU mix as a percentage of the total target LTI of each NEO, as represented below. | | | | | | | LONG-TERM INCENTIVE ANNUAL TARGET AWARD MIX | | CEO | All other NEOs | | |

The LTI award consists of a forward-looking stock award with an initial grant value determined based primarily on the prior year's annual Company PBTR performance and may vary year-to-year. Based primarily upon the 2019 PBTR results, the 2020 LTI award pool was funded at 105% of target. The Compensation Committee also considers secondary Company performance factors, key focus areas and relative performance, risk performance, regulatory compliance, and other factors relevant to the year when setting the LTI award pool. The number of PSUs and RSUs granted is determined by dividing the dollar value of each recipient's award by the fair market value of a share of common stock on the date of grant. The PSU and RSU grants were made in January 2020 to each of the NEOs. In early 2020, in recognition of Mr. Hochschild's performance as CEO, and to bring his compensation closer to market-competitive levels, the Compensation Committee approved a 9% increase in his long-term incentive target. In early 2020, in recognition of their experience and performance, the Compensation Committee approved an 8% increase to the 2020 LTI target for both Mses. Loeger and Offereins and Mr. Minetti. The Compensation Committee made no other changes to the 2020 LTI targets of the other then-serving NEOs. See "2020 Decision-Making Process" below for more details on how the factors considered by the Compensation Committee impacted compensation decisions and see "2020 Summary Compensation Table" for the actual LTI grant values. Performance Stock Units 2020 PSU Awards At-risk PSUs are granted annually at the beginning of a three-year Company performance period to further reinforce the NEOs' accountability for the Company's future financial and strategic goals by tying a significant portion of compensation directly to the Company's EPS and stock price. The majority of the 2020 LTI awards for NEOs consisted of PSUs (75% for the CEO, and 60% for the other NEOs), which were granted under the Company's 2014 Omnibus Incentive Plan. Under this program, PSUs will generally vest and convert to shares of Common Stock if and to the extent the Company achieves specific cumulative EPS performance goals over a three-year performance period and provided the executive remains employed by the Company for the three-year performance period (with exceptions for certain termination events), and are subject to an evaluation of compliance with the Company's risk policies over the three-year period prior to vesting. The performance period for the 2020 award of PSUs began on January 1, 2020 and ends on December 31, 2022. The EPS performance target is established during the annual business planning process and is intended to push the Company and the NEOs to achieve higher performance within the Company's risk framework. Target PSU payout will be achieved if the Company meets its cumulative business plan goals, while achievement of maximum and threshold performance goals are each expected to be infrequent in occurrence. Participants will receive no portion of the award if the minimum performance is not met. If the Company exceeds the target performance hurdles, the NEO can potentially earn an award in excess of the target, up to a maximum of one and one-half times the target award based on Company performance. The awards will receive dividend equivalents in cash which will accumulate and pay out if and when the underlying shares are released to the NEOs.

Compensation Discussion and Analysis 2018 PSU Payouts The performance period for our PSUs granted in February 2018 was completed on December 31, 2020. The cumulative diluted EPS over the three-year period was $20.47 versus a target of $25.54, which would have resulted in a payout factor of 67% of the target amount. An EPS of $12.77 and $29.37 were required to receive a minimum and maximum payout, respectively. In assessing the appropriate payout for these PSUs, the Compensation Committee considered the EPS over the performance period attributable to effective NEO execution of key business decisions and strategies, including strong focus on growth and credit risk management. The Compensation Committee also considered the impact of accounting changes related to reserving under the current expected credit losses ("CECL") on Company performance. 2018 PSU EPS targets were established pre-CECL using the incurred reserve methodology, and the Compensation Committee therefore considered whether adjustments should be made to performance and appropriate metrics to account for CECL. Consistent with the Company's pay-for-performance philosophy and in accordance with the provisions of the 2014 Omnibus Incentive Plan, the Compensation Committee may adjust target amounts to reflect the impact of factors that management cannot directly control and to ensure that payout factors are not artificially inflated or impaired by factors unrelated to the ongoing operations of the business. Based on its assessment of the impact of CECL, the Compensation Committee increased the payout factor to 79% of target. The final payout of these PSUs was determined after confirmation of compliance with the Company’s risk policies, and employees received earned shares (which remain subject to clawback provisions, and for NEOs, subject to the share ownership guidelines and share retention requirements) when they vested in February 2021. Restricted Stock Units In addition to time-based vesting, RSUs are subject to market variability tied to the Company stock price and are intended to align the interests of senior executives with the long-term interests of the Company and its shareholders as well as motivate future contributions and decisions aimed at increasing shareholder value. RSUs generally vest and convert to shares ratably over a three-year period, subject to compliance with the Company's risk policies and assuming the executive remains employed by the Company through the vesting date (with exceptions for certain termination events). The awards deliver dividend equivalents in cash, which are paid to the NEOs in the same amount and at the same time as dividends are paid to all Company common shareholders. 2020 Decision-Making Process Factors Affecting Compensation Decisions  The primary Company performance factor considered by the Compensation Committee when assessing performance for purposes of making variable compensation decisions for 20172020 was the Company's PBTR. Although no set weight is assigned to any performance metric or goal, we believe that a profit-based measure best reflects overall Company performance and drives EPS, which we believe is the representative measure most directly tied to the return to our common shareholders. We believe PBTR is also a balanced measure aligned with overalltotal performance to motivate executives to focus on the overall returns of the Company and not drive performance on one measure or one business unit over another. In 2017,2020, the Compensation Committee considered the Company's PBTR along with other performance factors, including: performance against Annual Plan; net income,income; ROE (and risk-adjusted returns), EPS,; EPS; total revenue (defined as net interest income plus other income),; net charge-offs and operating expenses,expenses; key focus areas; relative performance; risk performance; regulatory compliance; internal pay equity; and individual performance. In 2020, the Company was forced to adjust and adapt to the impact of the COVID-19 global pandemic. While our performance remained solid, the impact of the pandemic on our business, and particularly the credit portion of our business was significant. On a year-over-year basis, our PBTR decreased 8%(1) from $4,180 million to $3,834 million(1) on an unadjusted basis. Management's clear vision and quick action at the outset of the pandemic, along with proactive steps to minimize the impact on our lending business and offset performance headwinds through cost reductions helped to mute the impact of the COVID-19 pandemic on our business and workforce. Despite the impact of the COVID-19 pandemic on company performance, management did not request nor were adjustments made to the 2020 Annual Plan or Company performance targets under the Company's bonus plan and PSU program to account for COVID-19.

____________________ (1)Profit before taxes and reserves ("PBTR") is a non-GAAP financial measure which should be viewed in addition to, not as a substitute for, the Company's reported results. PBTR is derived by adding the increase in the allowance for credit losses of $2,382 million, the build of the liability for expected credit losses on unfunded commitments of $17 million, and income tax expense of $294 million to net income of $1,141 million. The Compensation and Leadership Development Committee believes that PBTR is a critical measure of the core operating performance of the business that increases focus on factors the Company's incentive-eligible employees are most able to directly impact and influence and controls for variability in significant macroeconomic impacts. Please see "Annex A" for a reconciliation of PBTR growth to net income growth calculated in accordance with GAAP.

Compensation Discussion and Analysis Given our business model that relies heavily on the contribution of U.S.-based call center employees, management was forced to quickly act to move those and other employees from on-premise service to a work-from-home model. Within a period of three weeks, we moved nearly 98% of our global workforce to a work-form-home environment. Accordingly, the Company's 2020 business performance was impacted, and leadership and management priorities for 2020 were adjusted to account for the impact of COVID-19. Rather than rework 2020 performance goals and targets, management incorporated additional COVID-19 key focus areas relative performance, risk performance, internal pay equitythat were necessary to successfully manage through the pandemic in addition to continuing corporate and individual performance.performance goals. The Compensation Committee considered performance against these focus areas in addition to other qualitative performance metrics applicable to our executives. For the PSU portion of the LTI program, the primary metric the Compensation Committee established for performance-vesting purposes was cumulative EPS achievement over a three-year performance period. In making final award determinations for the 2018-2020 PSUs, the Compensation Committee also factored in individual compliance with the Company's risk policies andincluding an assessment of any inappropriateimprudent risks taken over the three-year vesting period, inclusive of the performance period. In 2017, theThe Compensation Committee in consultation with Pearl Meyer, considered alternative performance metrics for PSUs. The Committee also met with the Company's Chief Financial Officer, Mr. Graf, to discuss Company performance. After considering alternatives, the Committee chose to continue to use EPS as the sole PSU metric because it is deemed to be transparent, directly tied to the return to our shareholders and a commonly-used indicator of profitability for publicly-traded companies. The Committee continues to maintainretains discretion to adjust EPS performance for the impact of unusual or non-recurring events not reflected in business plan assumptions including legislative, accounting or other regulatory changes;changes, one-time, unusual tax events, and significant changes in planned share repurchases where such events are not attributable to NEO performance for purposes of PSU vesting. In December 2017, in light of the then pending tax legislation, the Committee clarified such events included the impact of any tax code changes. The Compensation Committee also considered the need to attract, motivate, and retain a talented management team and to design our compensation program in a way that remains competitive with other companies with which we compete for senior executive talent. For 2017,2020, after consideration of all the aforementioned factors and the Compensation Committee’s emphasis on pay for performance,pay-for-performance, the Compensation Committee made compensation decisions for each of the NEOs as detailed in the "2017"2020 Summary Compensation Table." Consistent with past practice, STI was paid after the Compensation Committee meeting in January 2021 and LTI was granted after the regularly scheduled Committee meeting in February 2018.2020.

Overall Company and Business Segment Performance The Compensation Committee believes that the actions taken by the Company's CEO and the other NEOs throughout 2017 contributed greatly to the Company's results and better positioned2020 helped the Company for 2018to overcome the unique challenges that accompanied the COVID-19 global pandemic while continuing to pursue our business objectives and beyond. Furthermore, throughout 2017,placed the Company continuedin a position to benefit from certain strategic choices made by the Company's senior managementsucceed in prior years.2021 and beyond. The following key strategic decisions, among other things, enabled the Company to be profitable during 2017maintain profitability in 2020 and we believe placed the Company in a strong position going forward: •Credit performance was strong across all of our lending products driven by the actions we’ve taken in underwriting, credit line management and collections, and the resiliency of our prime customer base. •Total loans decreased 6% year-over year, resulting from tightened underwriting criteria combined with elevated payment rates. However, we took substantial share in private student lending and gained share in card lending. •Operating efficiency ratio(1) of 41% reflects lower revenue driven by decreased net interest income and increased operating expenses. The increase in expenses was primarily driven by higher compensation expense and several one-time items, partially offset by lower marketing costs. •Delivered on our commitment to cut planned expenses by $400 million in 2020. •Continued to invest in analytics, automation and core technology capabilities to support long-term growth and efficiency improvement. •Payment Services continued to have strong network volume growth, up 7% year-over-year and generated $172 million in pre-tax income, driven primarily by strong PULSE performance. •In early 2021 our Board of Directors approved a new $1.1 billion repurchase plan, and we may begin share buybacks as soon as the first quarter subject to the Federal Reserve’s limitations.

____________________ (1)Operating efficiency ratio represents total other expense divided by revenue net of interest expense.  22

Accelerated revenue growth while also generating faster loan growthCompensation Discussion and maintaining a disciplined approach to credit.Analysis

Maintained a disciplined focus on key initiatives including the launch of Social Security Number Alerts and New Account Alerts, aimed at helping Discover cardmembers protect themselves from identity theft or fraud.

Enhanced digital and mobile capabilities providing operational efficiencies and building upon our position as a customer service leader.

Improved network acceptance, domestically and internationally, through increased merchant and acquirer relationships and network-to-network partnerships.

Utilized deposit growth initiatives and capital markets transactions to maintain a balance sheet position to benefit from a rising interest rate environment.

| | • | Maintained strong capital position while returning over $2.5 billion(1) of capital to shareholders in buybacks and Common Stock dividends.

|

Achieved termination of the FDIC consent order relating to Discover Bank’s AML program.

Continued to enhance governance practices and the risk management and control environment, focused on meeting regulatory guidance.

Financial Performance  The primary factor that our Compensation Committee considered in making 20172020 compensation decisions was the Company's PBTR. The Company's 2017 Annual Plan target for PBTR was modestly lower than prior year results due to our increased projected loan loss provision from loan growth seasoning and industry credit normalization and as we increased our growth investments to accelerate growth and long-term profits.growth. The Company achieved PBTR of $3,997$3,834 million(2)(1), which exceededrepresented a year-over-year decrease of 8%(1). While our 2017 Annual Plan targetinitial 2020 business plan contemplated year-over-year growth in PBTR, the impact of $3,929 million.the COVID-19 global pandemic was substantial and significantly impacted the Company's PBTR performance. Notwithstanding the setbacks resulting from COVID-19, PBTR performance was encouraging and we believe reflects the strength and resiliency of Discover's digital banking business model. The Compensation Committee consideredconcluded that PBTR performance was drivenimpacted by favorability in revenueCOVID-19 but remained solid due to strong operational and operating expenses partially offsetfinancial actions by higher charge-offs.management.

Other Performance Factors Other Financial Metrics The Compensation Committee considered other secondary 20172020 financial metrics set forth below. No single secondary financial metric was by itself significant to the Compensation Committee's determination of any individual's compensation. The Committee reviewed the impact of unplanned events, including the Tax Cuts and Jobs Act, and subjectively balanced 20172020 financial performance across these secondary metrics in the aggregate in determining individual compensation. | The following financial metrics were considered by the Committee (dollars in millions, except per share amounts): | | | | | | | | | 2017 | | Change from 2016 | Total Revenue(3) | $9,897 | | 9 | % | | Net Charge-off Dollars | $2,119 | | 36 | % | | Operating Expense | $3,781 | | 5 | % | | Net Income | $2,099 | | (12 | %) | | Diluted Earnings Per Share | $5.42 | | (6 | %) | | Return on Equity | 19 | % | | (2 | %) | | | | | |

| | (1) | The sum of Common Stock dividends and share repurchases, net of Common Stock issued under stock-based compensation plans. |

| | (2) | Profit before taxes and reserves ("PBTR") is a non-GAAP financial measure which should be viewed in addition to, not as a substitute for, the Company's reported results. PBTR is derived by adding the increase in the allowance for loan losses of $460 million and income tax expense of $1,438 million to net income of $2,099 million. The Committee believes that PBTR is a better measure of the core operating performance of the business that increases focus on factors the Company's incentive-eligible employees are most able to directly impact and influence and controls for variability in significant macroeconomic impacts.

|

| | (3) | Total revenue equals the sum of net interest income and other income. |

The following financial metrics were considered by the Compensation Committee (dollars in millions, except per share amounts):

| | | | | | | | | | 2020 | Change from 2019 | Total Revenue(2) | $11,088 | (3)% | | Net Charge-off Dollars | $2,735 | (5)% | | Operating Expense | $4,519 | 3% | | Net Income | $1,141 | (61)% | | Diluted Earnings Per Share | $3.60 | (60)% | | Return on Equity | 11% | (15)% |

23

Key Focus Areas The Compensation Committee also considered the Company's progress on key focus areas, including accelerating profitableloan and deposit growth, enhancing capabilities and operating models, reducing charge-offs and disciplined expense management, growing the Payments business, progress on maturing risk management, and compliance when making overall compensation decisions. For 2020, management also added and the Compensation Committee approved as an additional performance factor a special Key Focus Area COVID-19 Response, which included protecting employees and our franchise, maintaining strong capital and liquidity positions, managing credit and collections, reducing operating expenses, and sustaining brand capabilities and profitable growth momentum. The Compensation Committee reviewed and subjectively balanced performance in these key focus areas with other secondary factors and PBTR in the aggregate in determining individual compensation.

____________________ (1)Profit before taxes and reserves ("PBTR") is a non-GAAP financial measure which should be viewed in addition to, not as a substitute for, the Company's reported results. PBTR is derived by adding the increase in the allowance for credit losses of $2,382 million, the build of the liability for expected credit losses on unfunded commitments of $17 million, and income tax expense of $294 million to net income of $1,141 million. The Compensation and Leadership Development Committee consideredbelieves that PBTR is a critical measure of the core operating performance of the business that increases focus on factors the Company's incentive-eligible employees are most able to directly impact and influence and controls for variability in significant macroeconomic impacts. Please see "Annex A" for a reconciliation of credit normalizationPBTR growth to net income growth calculated in accordance with GAAP. (2)Total revenue equals the sum of net interest income and loan growth, as well as total network transaction volume. other income.

Compensation Discussion and Analysis The following secondary growth and performance metricsfactors were reviewed by the Compensation Committee: •Total loan growth of receivables decreased 6% year-over year, resulting from tightened underwriting criteria combined with elevated payment rates. However, we took substantial share in private student lending and gained share in card lending. •9% was above the 2016 performance of 7%, supported by strong sales growth and continued payment rate favorability. Loan growth is a key driver of revenue and future profitability, and 9% organic loan growth was our best performance since becoming a public company in 2007. Direct Banking revenue was higherlower than 2016 by 9%2019 driven by loan growth as well as net interest margin expansion.repayment trends and lower sales volume.

•Direct-to-Consumer Deposits grew year-over-year by $9,088 million, or 17%. •Total net charge-off rate on average loans outstanding of 2.70%3.03% was updown from the prior year rate of 3.17% . •2.16%Operating efficiency ratio(1) dueof 41% reflects lower revenue driven by decreased net interest income and increased operating expenses. The increase in expenses was primarily driven by higher compensation expense and several one-time items, partially offset by lower marketing costs. •Payment Services continued to supply-driven credit normalization and the seasoning of loan growth from the last few years. | | • | The Company achieved an operating efficiency ratio(1) of 38.2%, which was an improvement when compared to the 2016 ratio of 39.4%. Strong growth in Direct Banking revenue was the primary contributor to the improvement.

|

Totalhave strong network volume was higher than the prior year by 10%growth, up 7% year-over-year and generated $172 million in pre-tax income, driven primarily by strong PULSE network volume growth of performance.

•14%.Company and individual risk performance with respect to legal and regulatory matters. Payment Services pre-tax earnings of $145 million were above 2016 by $38 million driven by higher PULSE transaction processing revenue and expense favorability.

The Company made significant investments and has made substantial progress in enhancing risk management and compliance, including its AML/BSA program.

Relative Performance The Compensation Committee also considers the Company's performance relative performance againstto our largest business competitors in the U.S. market in both the DirectDigital Banking and Payment Services segments. Relative performance results considered byIn 2020, Discover performed better than the Committee for 2017 are described below. Unless otherwise noted, the Committee reviewed competitor results for trailing four calendar quarters through completionmajority of the fourth calendar quarterits largest competitors on metrics including ROE and efficiency ratio and continued to gain market share in 2017. | | • | Card Credit:3% net charge-off rate average; better than the average competitor rate(2)

|

| | • | Card Loans:9% receivables growth: better than the average competitor growth rate(2)(3)

|

| | • | Credit Volume: 5% U.S. credit dollar volume growth; lower than the average network competitors(4)

|

| | • | Debit Volume:14% U.S. debit dollar volume growth; better than the average competitor growth rate(5)

|

| | • | Card Return on Assets: 6% one-year return on assets; better than the average competitor return(6)(7)

|

| | • | Return on Equity:19% one-year return on equity; better than the average competitor return(8)

|

| | • | Shareholder Return: 9% one-year total shareholder return; lower than the average competitor return(9)

|

| | • | Shareholder Return: 25% three-year total shareholder return; lower than the average competitor return(9)

|

primary lending products and grow consumer deposits.

____________________

| | (1) | Operating efficiency ratio represents total other expense divided by revenue net of interest expense. |

| | (2) | Card comparison based on peer group of American Express (U.S. Consumer Card), Bank of America (U.S. Card), Capital One (U.S. Card), Chase (Card Services), Citibank, N.A. (Branded-Cards North America), Synchrony Financial (Retail Card) and Wells Fargo (Consumer Card). |

| | (3) | Card receivables growth is on a year-over-year basis. |

| | (4) | Network competitors are American Express, Visa and Mastercard. Credit volume growth is on a year-over-year basis. |

| | (5) | Competitor average based on peer group of Visa and Mastercard. Debit volume growth is on a year-over-year basis. |

| | (6) | Card competitor average based on peer group of American Express (U.S. Consumer Card), Capital One (U.S. Card), Citibank, N.A. (Branded-Cards North America) and Synchrony Financial (Total Company). |

| | (7) | Card return on assets is calculated by dividing profit before taxes and reserves by average credit card loan receivables. |

| | (8) | Competitor average based on peer group of American Express, Bank of America, Capital One, JP Morgan Chase, Citigroup, Mastercard, Synchrony Financial, Visa and Wells Fargo. |

| | (9) | As of December 31, 2017, based on peer group of American Express, Bank of America, Capital One, Citigroup, JP Morgan Chase, Mastercard, Synchrony Financial, Visa and Wells Fargo. The Company's shareholder return represents the total return of a share of Common Stock to an investor (capital gain/loss plus dividends) assuming dividends are reinvested in the security. |

24

Risk Performance  The Compensation Committee considers risk performance across the Company and within each business segment in making final compensation decisions for each NEO, both as it relates to an individual’s specific objectives as well as contributions to the successstrengthening of the business in strengthening its risk management, internal controls, and compliance practices. The Compensation Committee notedreviewed overall performance in line withand risk adjusted returns and capital levels relative to the Annual Plan and within established business risk appetite limits, strong risk adjusted returns, strong capital levels and termination of the FDIC consent order relating to Discover Bank's AML program.limits. The Compensation Committee also considered the Company's substantial efforts in ongoing remediation to address previously disclosed legal and regulatory matters including a Written Agreement with the Federal Reserve relating to the Company's AML program as well as a2020 consent order with the CFPB related to the Company’s Student Loan business.

____________________ (1)Operating efficiency ratio represents total other expense divided by revenue net of interest expense.

Compensation Discussion and Analysis Individual Performance The Compensation Committee considers individual performance in making final compensation decisions for each NEO, both as it relates to an individual's specific objectives as well as each individual's relative role impact, experience, internal pay equity, and contributions to the success of the overall enterprise. As noted above, as part of its compensation determinations, the Compensation Committee also assesses each NEO’s contributions to the success of the business in strengthening its risk management, internal controls, and compliance practices, which reinforces these objectives as priorities throughout the organization. The Compensation Committee believes this holistic approach optimizes the link between executive rewards and the benefits to shareholders. Highlights of individual performance and contributions are described below.

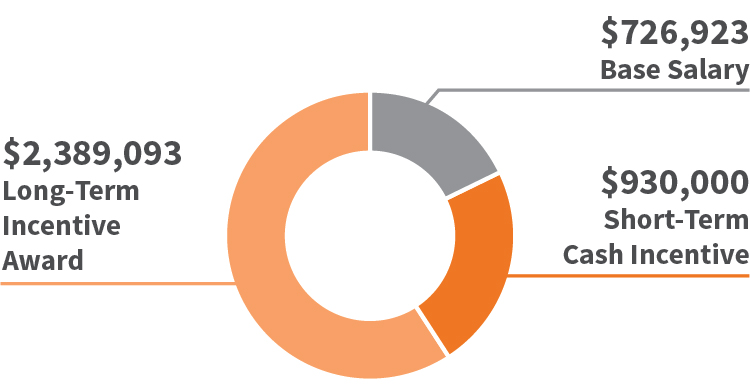

In 2020, the Compensation Committee recognized the contribution of management in identifying, addressing, managing and mitigating the impact of COVID-19 on the Company's business operations, including, but not limited to its impact on our customers, our employees and our business partners. Management did not recommend and the Compensation Committee did not pursue adjustments to Company PBTR performance targets under the STI Program, and instead focused on individual contribution to managing COVID-19 as reflected in the COVID-19 key focus areas described above, while simultaneously pursuing existing company and individual goals. The highlights below therefore reflect each member of management's contribution to managing the impact of COVID-19 on our business while also pursuing our established business strategy. | | | | | | | | | David W. NelmsROGER C. HOCHSCHILD

Chairman and Chief Executive Officer and President

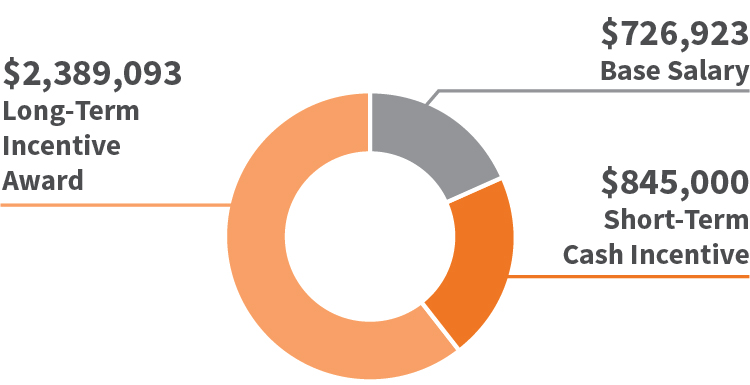

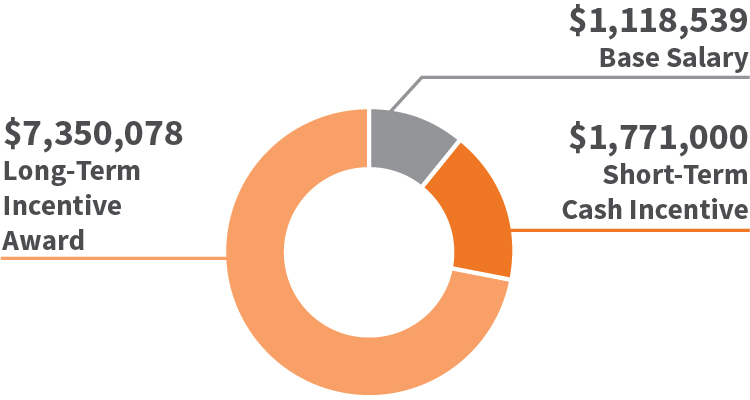

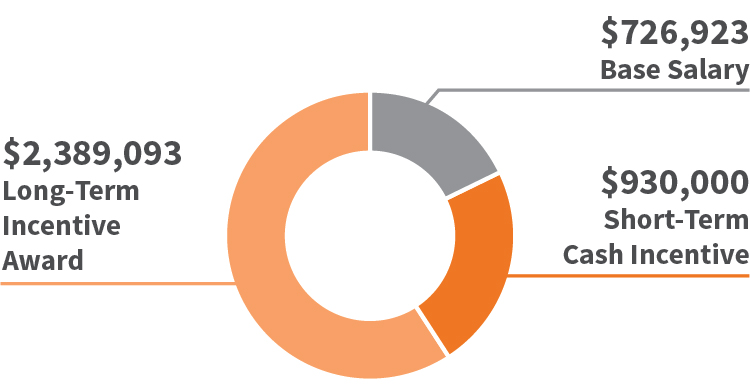

| | | | | 2020 COMPENSATION | Key Achievements | | | •Maintained strong PBTR performance and performance relative to competitors in challenging COVID-19 environment •Managed successful response to COVID-19 pandemic including seamless transition to work-from-home, $400 million expense reduction and rapid credit policy and customer service adjustments •Continued progress on build out of physical and digital acceptance | l•Exceeded Annual Plan target for PBTRContinued progress on technology transformation and loan growthmatched industry roll out of contactless payment

lManaged •strong EPS performance, despite provision higher than Annual PlanExpanded the company’s commitment to diversity, equity and inclusion by establishing a strategic Office and quick response Task Force dedicated to advancing these efforts

l•Achieved favorable company efficiency ratio of 38%

lRenewed payments volume and profit growth

lDrove timely progress on addressingSupported maturing risk management, including regulatory matters including related to the AML/BSA program which resulted in the termination of the FDIC consent orderrisk

|

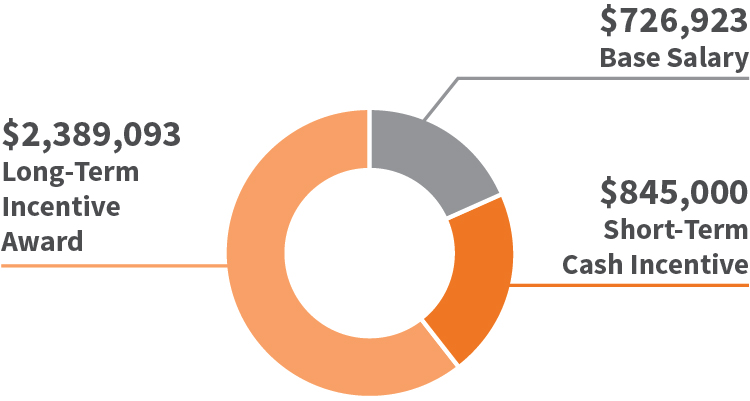

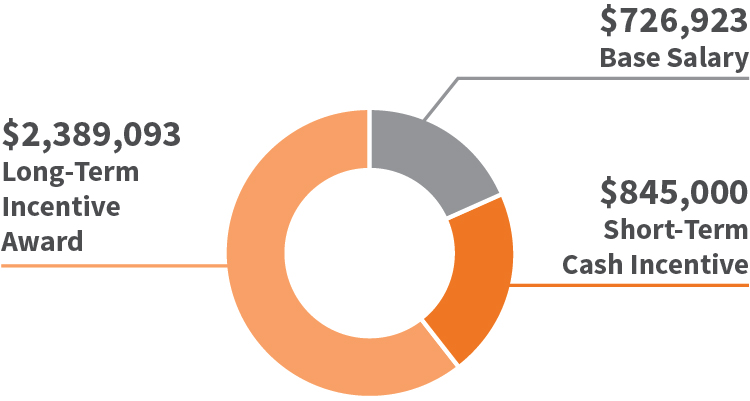

| | | | | | | | | R. Mark GrafJOHN T. GREENE

Executive Vice President, Chief Financial Officer

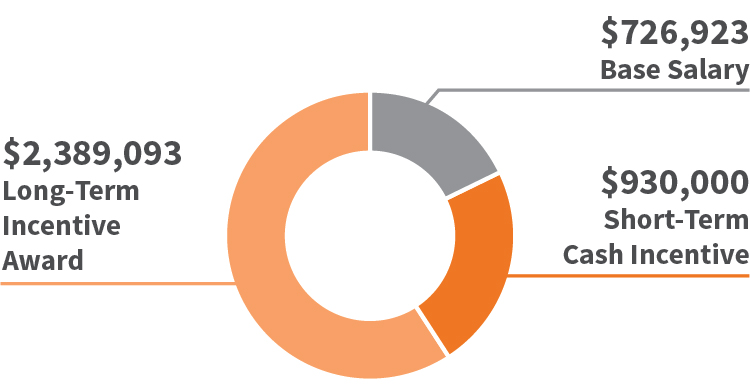

| | | | | 2020 COMPENSATION | Key Achievements | | | l•Exceeded treasury funding goalsManaged successful response to COVID-19 pandemic including implementing actions to assure strong liquidity and capital positions while executing expense reduction activities resulting in the aggregate$400 million of savings versus planned spend

l•Drove positive operating leverageSignificantly enhanced procurement and drovesourcing functions yielding $100 million savings through corporate procurementon third party vendor spend

| •Enhanced Financial Planning and Analysis ("FP&A") and line of business finance process resulting in efficiency and quicker cycle time l•FortifiedMaintained strong investor relations and enhanced business planning and reporting processes

•Developed a high quality capital plan and strengthened the corporate balance sheet through effective •Supported maturing risk management, including regulatory risk and capital management; supportedfinancial risks from COVID-19 pandemic |

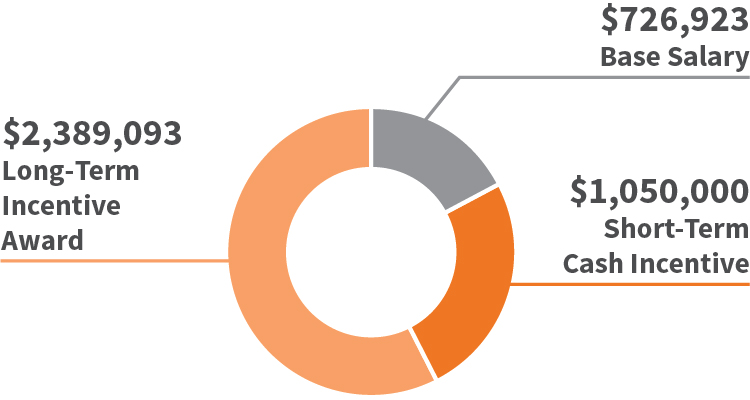

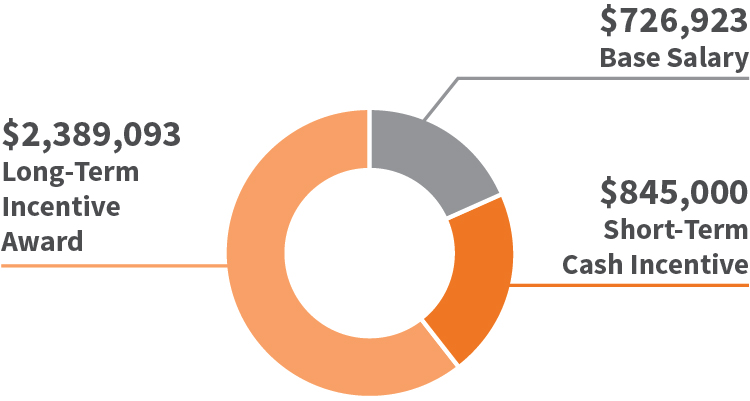

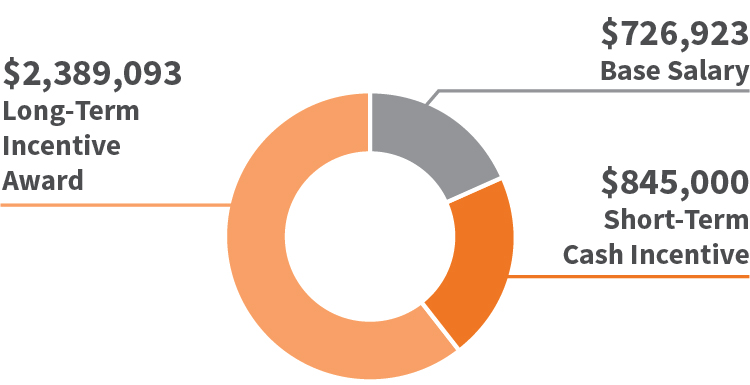

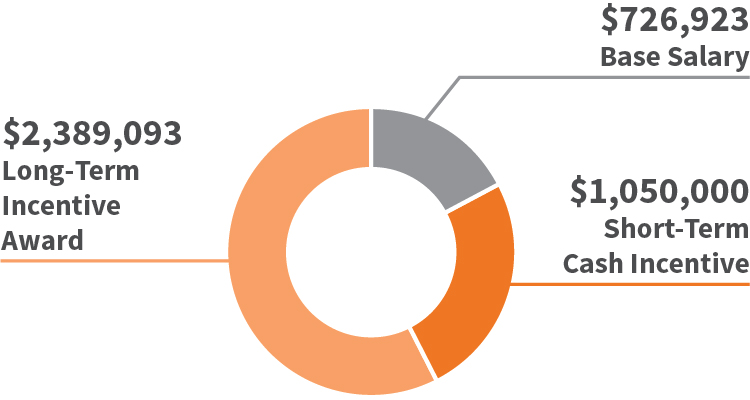

Compensation Discussion and Analysis | | | | | | | | | CARLOS M. MINETTI

Executive Vice President, President - Consumer Banking | | | | | 2020 COMPENSATION | Key Achievements | | | •Exceeded goals on Lending (PBTR), Personal Loans, Student Loans, Net Charge-Off Rates, and Deposits all governing•Co-sponsored a company-wide effort to improve operations, compliance, and risk management committee requirements

lContinued strength in investor relations, including industry recognition for this function

l•Launched new IRA Savings and Parent Loan products

| •Reduced the time to fund home loans from the time the application is submitted •Created an award winning home loan digital experience •Supported timely satisfaction ofmaturing risk management, including regulatory mattersrisk |

| | | | | | | | | Roger C. Hochschild

President and Chief Operating Officer

| lLed business segments to achieve strong financial performance

lContinued build out and maturation of the Company's Chief Information Security Office function and capabilities

lContinued roll out of "Discover Management System," a new operating model

leveraging lean and agile principles; leading the Executive Committee through learning journey and adoption of management tools and principles

lSupported progress on addressing regulatory matters including related to the AML/BSA program which resulted in the termination of the FDIC consent order

lCompleted several talent rotations at the officer level to build succession depth; successful transition of new Executive Committee member into Credit and Decision Management role

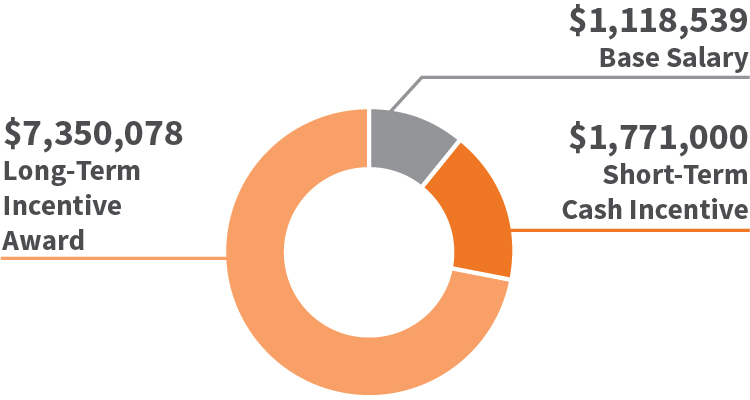

| | | DianeDIANE E. OffereinsOFFEREINS

Executive Vice President, President - Payment Services

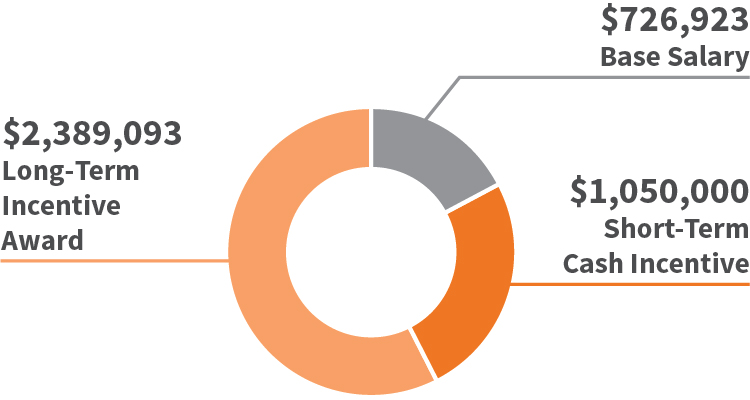

| | | | | 2020 COMPENSATION | Key Achievements | | | l•Exceeded Payments segment Annual Plan targetDelivered strong year-over-year performance in the aggregatedespite COVID-19 through aggressive cost cutting and actions to minimize counter-party losses

l•Increased global acceptance, stabilizedMaintained momentum with payments volume and increased Payment

Services profits

l Increased network acceptance, network-to-network partners and issuer base for PULSEdespite challenging environment

l•Launched Samsung Pay, Android Pay app provisioning, and PayPal in Android PayContinued successful implementation of technology roadmap

| •Successfully implemented Discover Card’s contactless initiative l•Launched Apple Pay for two Discover Debit issuersEstablished an operating model, transaction framework, and Pay with Cashback Bonus for Discover cardmembersnear-term roadmap

l •Supported progress on addressingmaturing risk management, including regulatory matters including related to the AML/ BSA sanctionsrisk

|

25

| | | | | | | | | Carlos Minetti

JULIE A. LOEGER

Executive Vice President, President of Consumer Banking- US Cards | | | | | 2020 COMPENSATION | Key Achievements | | | l•Implemented strategies to balance growth, risk and profitability across Consumer

Banking

lExceeded Consumer Banking Plan target for PBTR Delivered strong year-over-year sales performance despite COVID-19

l•Exceeded Annual Plan target for New DepositsManaged successful response to COVID-19 pandemic including aggressive cost cutting and met targets for other banking product new originationsadjustments to strategy to address customer needs

l •Implemented measures for sustained improvement in Discover Home EquityLaunched a highly effective No Annual Fee and Card Acceptance campaign

| •Launched black-owned restaurant initiative with focus on social media and influencers l •Continued focus on building next generation capabilities in OTIS banking system platformLaunched several new innovative products and mobile enhancements to improve the customer experience

l •Supported progress on addressingmaturing risk management, including regulatory matters including related to the AML/BSA program which resulted in the termination of the FDIC consent orderrisk

|

Compensation Discussion and Analysis RolePerformance Stock Units

2020 PSU Awards At-risk PSUs are granted annually at the beginning of NEOs in Compensation Decisions  Our CEO, COO, seniora three-year Company Human Resources personnel, Chief Risk Officer and Pearl Meyer met withperformance period to further reinforce the Committee to discuss preliminary compensation decisionsNEOs' accountability for the NEOsCompany's future financial and senior officers considering overall contribution to Company performance and individual responsibility for business segment, functional, and/or strategic goals during the Committee's December 2017 meeting and presented final recommendations to the Committee during the Committee's February 2018 meeting. The Committee also met with the Risk Oversight and Audit Committees of the Board of Directors to discuss the impact of risk performance on compensation recommendations. This allowed for ample review and consideration of 2017 Company, business segment, individual and risk performance in determining 2017 compensation decisions. No NEO was involved in his or her own pay recommendations or decisions. The role of the Committee and its consultant are discussed under "Executive and Director Compensation — Executive Compensation." The decisions of the Committee for 2017 performance are reflected below under "Components of Compensation."

Components of Compensation

2017 compensation decisions for our NEOs were closely tied to our 2017 financial performance and consisted of three key components - base salary, STI, and LTI - withby tying a significant portion of total compensation (PSUsdirectly to the Company's EPS and RSUs) tied to long-term Company performance. These components are summarized below.

Base Salary

We provide ourstock price. The majority of the 2020 LTI awards for NEOs and other executives with a market-competitive annual base salary to attract and retain an appropriate caliberconsisted of talentPSUs (75% for the position. Annually, we review our competitive market, including market dataCEO, and 60% for the other NEOs), which were granted under the Company's 2014 Omnibus Incentive Plan. Under this program, PSUs will generally vest and convert to shares of Common Stock if and to the extent the Company achieves specific cumulative EPS performance goals over a three-year performance period and provided the executive remains employed by Pearl Meyerthe Company for our proxy peer groupthe three-year performance period (with exceptions for certain termination events), and are subject to an evaluation of compliance with the Company's risk policies over the three-year period prior to vesting. The performance period for the 2020 award of PSUs began on January 1, 2020 and ends on December 31, 2022. The EPS performance target is established during the annual business planning process and is intended to push the Company and the broader market. The Committee uses market information as one data pointNEOs to consider among many, and changes in base compensation are not made frequently. For example, the base pay of Mr. Nelms has not changed since 2008, and the base salaries of Mr. Minetti and Ms. Offereins have not changed since 2011. After considering 2016 market increases in base pay, individualachieve higher performance and experience, the Committee approved a $100,000 increase in Mr. Nelms base salary for 2017. After considering 2017 market increases in base pay, individual performance, relative role impact, experience, and internal pay equity amongstwithin the Company's executive officers,risk framework. Target PSU payout will be achieved if the Committee approvedCompany meets its cumulative business plan goals, while achievement of maximum and threshold performance goals are each expected to be infrequent in occurrence. Participants will receive no portion of the award if the minimum performance is not met. If the Company exceeds the target performance hurdles, the NEO can potentially earn an award in excess of the target, up to a $50,000 increase inmaximum of one and one-half times the 2018 base salaries for each of Messrs. Graf, Hochschild, and Minetti and Ms. Offereins. The Company applies any applicable annual base salary increases for all employees, including NEOs, as of a specified date in the first three and a half months of each year. See "2017 Summary Compensation Table" for a summary of 2017 NEO base salaries.

Short-Term Incentive Program

In 2017, we continued to offer our NEOs the opportunity to earn a market competitive annual cashtarget award based on Company performance. The awards will receive dividend equivalents in cash which will accumulate and pay out if and when the underlying shares are released to the NEOs.

Compensation Discussion and Analysis 2018 PSU Payouts The performance period for our PSUs granted in February 2018 was completed on December 31, 2020. The cumulative diluted EPS over the three-year period was $20.47 versus a target of $25.54, which would have resulted in a payout factor of 67% of the target amount. An EPS of $12.77 and $29.37 were required to receive a minimum and maximum payout, respectively. In assessing the appropriate payout for these PSUs, the Compensation Committee considered the EPS over the performance period attributable to effective NEO execution of key business decisions and strategies, including strong focus on growth and credit risk management. The Compensation Committee also considered the impact of accounting changes related to reserving under the current expected credit losses ("CECL") on Company performance. 2018 PSU EPS targets were established pre-CECL using the incurred reserve methodology, and the Compensation Committee therefore considered whether adjustments should be made to performance and appropriate metrics to account for CECL. Consistent with the Company's financial performance,pay-for-performance philosophy and in accordance with the provisions of the 2014 Omnibus Incentive Plan, the Compensation Committee may adjust target amounts to reflect the impact of factors that management cannot directly control and to ensure that payout factors are not artificially inflated or impaired by factors unrelated to the ongoing operations of the business. Based on its assessment of the impact of CECL, the Compensation Committee increased the payout factor to 79% of target. The final payout of these PSUs was determined after confirmation of compliance with the Company’s risk policies, and employees received earned shares (which remain subject to clawback provisions, and for NEOs, subject to the share ownership guidelines and share retention requirements) when they vested in February 2021. Restricted Stock Units In addition to time-based vesting, RSUs are subject to market variability tied to the Company stock price and are intended to align the interests of senior executives with the long-term interests of the Company and its shareholders as well as other secondarymotivate future contributions and decisions aimed at increasing shareholder value. RSUs generally vest and convert to shares ratably over a three-year period, subject to compliance with the Company's risk policies and assuming the executive remains employed by the Company through the vesting date (with exceptions for certain termination events). The awards deliver dividend equivalents in cash, which are paid to the NEOs in the same amount and at the same time as dividends are paid to all Company common shareholders. 2020 Decision-Making Process Factors Affecting Compensation Decisions The primary Company performance factors, riskfactor considered by the Compensation Committee for purposes of making variable compensation decisions for 2020 was the Company's PBTR. Although no set weight is assigned to any performance metric or goal, we believe that a profit-based measure best reflects overall Company performance and individual performance. The STI opportunitydrives EPS, which we believe is providedthe representative measure most directly tied to the return to our common shareholders. We believe PBTR is also a balanced measure aligned with total performance to motivate executives to achieve our annual business goals and to attract and retain an appropriate caliber of talent for the position, recognizing that similar annual STI opportunities are provided at other companies with which we compete for talent. After consideration of market data provided by Pearl Meyer, the Committee made no changes to 2017 target STI opportunities from 2016 target STI opportunities. Our NEOs have target STI opportunities, representedfocus on the "2017 Grantsoverall returns of Plan-Based Awards" table, which were communicatedthe Company and not drive performance on one measure or one business unit over another. In 2020, the Compensation Committee considered the Company's PBTR along with other performance factors, including: performance against Annual Plan; net income; ROE (and risk-adjusted returns); EPS; total revenue (defined as net interest income plus other income); net charge-offs and operating expenses; key focus areas; relative performance; risk performance; regulatory compliance; internal pay equity; and individual performance. In 2020, the Company was forced to themadjust and adapt to the impact of the COVID-19 global pandemic. While our performance remained solid, the impact of the pandemic on our business, and particularly the credit portion of our business was significant. On a year-over-year basis, our PBTR decreased 8%(1) from $4,180 million to $3,834 million(1) on an unadjusted basis. Management's clear vision and quick action at the beginningoutset of the year.

26

In 2017,pandemic, along with proactive steps to minimize the Committee again considered market data provided by Pearl Meyer, including forimpact on our proxy peers. Market data is only one factor used bylending business and offset performance headwinds through cost reductions helped to mute the Committee,impact of the COVID-19 pandemic on our business and is generallyworkforce. Despite the impact of the COVID-19 pandemic on company performance, management did not independently used as a basis for changesrequest nor were adjustments made to STI targets. The Committee considered market changes, individualthe 2020 Annual Plan or Company performance experience, and internal pay equity amongsttargets under the Company's executive officers,bonus plan and decidedPSU program to increase the 2018 target STI opportunityaccount for Messrs. GrafCOVID-19.

____________________ (1)Profit before taxes and Minetti and Ms. Offereins by 10%, and the increases were communicated to them at the beginning of 2018. PBTR is the primary factor considered when funding incentive compensation. PBTR is derived by adding changes in the allowance for loan losses to pretax income. PBTRreserves ("PBTR") is a non-GAAP financial measure thatwhich should be viewed in addition to, and not as a substitute for, the Company's reported results. PBTR is derived by adding the increase in the allowance for credit losses of $2,382 million, the build of the liability for expected credit losses on unfunded commitments of $17 million, and income tax expense of $294 million to net income of $1,141 million. The Compensation and Leadership Development Committee believes that PBTR is a bettercritical measure of the core operating performance of the business and is consistent with the evolution of our STI program in recent years to increasethat increases focus on factors the Company's incentive-eligible employees are most able to directly impact and influence and controls for variability in significant macroeconomic impacts. Please see "Annex A" for a reconciliation of PBTR growth to net income growth calculated in accordance with GAAP.

Compensation Discussion and Analysis Given our business model that relies heavily on the contribution of U.S.-based call center employees, management was forced to quickly act to move those and other employees from on-premise service to a work-from-home model. Within a period of three weeks, we moved nearly 98% of our global workforce to a work-form-home environment. Accordingly, the Company's 2020 business performance was impacted, and leadership and management priorities for 2020 were adjusted to account for the impact of COVID-19. Rather than rework 2020 performance goals and targets, management incorporated additional COVID-19 key focus areas that were necessary to successfully manage through the pandemic in addition to continuing corporate and individual performance goals. The Compensation Committee considered performance against these focus areas in addition to other qualitative performance metrics applicable to our executives. For 2017, the PSU portion of the LTI program, the primary metric the Compensation Committee established for performance-vesting purposes was cumulative EPS achievement over a three-year performance period. In making final award determinations for the 2018-2020 PSUs, the Compensation Committee also factored in individual compliance with the Company's risk policies including an assessment of any imprudent risks taken over the three-year vesting period, inclusive of the performance period. The Compensation Committee retains discretion to adjust EPS performance for the impact of unusual or non-recurring events not reflected in business plan assumptions including legislative, accounting or other regulatory changes, one-time, unusual tax events, and significant changes in planned share repurchases where such events are not attributable to NEO performance for purposes of PSU vesting. The Compensation Committee also considered secondary Company financial performance metrics, including net income, ROE (and risk-adjusted returns), EPS, total revenue (defined as net interest income plusthe need to attract, motivate, and retain a talented management team and to design our compensation program in a way that remains competitive with other income), net charge-offs, operating expenses, key focus areas, relative performance, risk performance, internal pay equity and individual performance. The Committee believes this providescompanies with which we compete for senior executive talent. For 2020, after consideration of all the right level of transparency while maintaining the flexibility to adjust for extraordinary circumstances that positively or negatively affect the Company's financial performance. This approach also allows the Committee to evaluate whether pay is commensurate with risks takenaforementioned factors and the quality of performance results. In 2017,Compensation Committee’s emphasis on pay-for-performance, the Company achieved PBTR of $3,997 million(1), which exceeded our 2017 Annual Plan PBTR target of $3,929 million. Accordingly, when determining 2017 STICompensation Committee made compensation decisions the Committee assessed PBTR versus the Annual Plan target and made a discretionary judgment on appropriate 2017 STI compensation for each of the NEOs based on a number of factors, including strong loan growth.as detailed in the "2020 Summary Compensation Table." STI was paid after the Compensation Committee meeting in January 2021 and LTI was granted after the regularly scheduled Committee meeting in February 2020.

Overall Company and Business Segment Performance The Company pays STI for eligible employees, including NEOs, as of a specified date in the first three and a half months of each year. See "2017 Decision-Making Process" above for more details on the factors considered by the Committee in compensation decisions and see "2017 Summary Compensation Table" for the actual STI decisions.

Long-Term Incentive Program

The Committee, with input from Pearl Meyer, continues to emphasize stock-based compensation for our NEOs to align their long-term interests with our shareholders. The Committee believes that the use of RSUs and PSUs that vest over a multi-year period focuses executives onactions taken by the Company's CEO and the other NEOs throughout 2020 helped the Company to overcome the unique challenges that accompanied the COVID-19 global pandemic while continuing to pursue our business objectives and placed the Company in a position to succeed in 2021 and beyond. The following key strategic decisions, among other things, enabled the Company to maintain profitability in 2020 and we believe placed the Company in a strong position going forward:

•Credit performance was strong across all of our lending products driven by the actions we’ve taken in underwriting, credit line management and collections, and the resiliency of our prime customer base. •Total loans decreased 6% year-over year, resulting from tightened underwriting criteria combined with elevated payment rates. However, we took substantial share in private student lending and gained share in card lending. •Operating efficiency ratio(1) of 41% reflects lower revenue driven by decreased net interest income and increased operating expenses. The increase in expenses was primarily driven by higher compensation expense and several one-time items, partially offset by lower marketing costs. •Delivered on our commitment to cut planned expenses by $400 million in 2020. •Continued to invest in analytics, automation and core technology capabilities to support long-term interests without leadinggrowth and efficiency improvement. •Payment Services continued to imprudent risk taking. have strong network volume growth, up 7% year-over-year and generated $172 million in pre-tax income, driven primarily by strong PULSE performance. •In addition, time-vested RSUsearly 2021 our Board of Directors approved a new $1.1 billion repurchase plan, and performance-vested PSUs represent an efficient methodwe may begin share buybacks as soon as the first quarter subject to the Federal Reserve’s limitations.

____________________ (1)Operating efficiency ratio represents total other expense divided by revenue net of delivering long-term stockinterest expense.